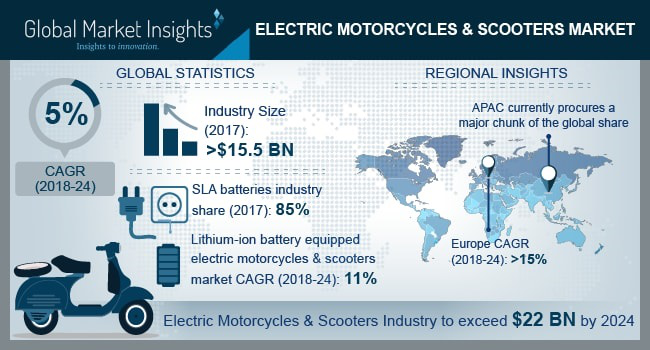

According to a new research report by Global Market Insights (Inc.), the market for electric motorcycles and scooters is estimated to exceed $22 billion by 2024.

Electromagnetic principles are used in the operation of electric vehicles, and the only factors that cause efficiency losses are transmission lines and friction. Therefore, the efficiency of the motors used in these vehicles exceeds 85% to 90%, which is very high compared to ice-powered vehicles that provide 40% thermal efficiency. In addition, plug-in powered vehicles contribute the least to greenhouse gases and air pollution, thus contributing to the improvement of urban air quality. These factors are expected to present viable growth prospects for the electric motorcycle and scooter market during the forecast period.

In 2017, scooters accounted for more than 85% of the market for electric motorcycles and scooters. This can be attributed to its increasing application in urban areas, where high mobility is one of the main traffic problems. The scooter is designed to be lightweight and easy to operate, with a speed range of 30 miles per hour, which reduces the cost of ownership and is the preferred mode of transportation, especially in metro cities.

Favorable regulatory standards and incentive programs implemented by regional authorities will also promote the growth of the electric motorcycle and motorcycle market during the forecast period. For example, in 2010, Ontario implemented a green license plate and electric vehicle (EV) tax rebate program, saving car owners a lot of costs in maintenance, fuel, and access to high occupancy vehicle (HOV) lanes. These plans are expected to increase users’ motivation to adopt electric motorcycles and scooters and help increase global recognition of the role of these vehicles in reducing global emissions of greenhouse gases and harmful pollutants.

Browse through 250 pages of key industry insights, including 623 market data tables and 10 data and charts from the report, “Electric motorcycles and scooters market size (motorcycles, scooters), batteries (SLA, lithium ion, NiMH) ), voltage (24V, 36V, 48V) industry analysis report, regional outlook (United States, Canada, Austria, Belgium, Czech Republic) LIC, France, Germany, Italy, Netherlands, Poland, Slovenia, Spain, United Kingdom, China, Japan, India, South Korea, Indonesia, Taiwan, Vietnam, Thailand, Malaysia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa), growth potential, price trends, competitive market share and forecasts, 2018-2024.”

Due to its high charge density, light weight, and high charge and discharge efficiency of lithium-ion batteries, the market for electric motorcycles and scooters is expected to grow at a rate of about 11% within the forecast period. In 2018, KTM announced the launch of lithium-ion batteries with a power range of 50% more than previous models. In addition, these batteries are replaceable and can be installed in traditional bicycle models.

48V batteries dominate the electric motorcycle and scooter market, accounting for more than 35% of sales in 2017. Excellent power output and compatibility of these batteries with electronic vehicles will drive the growth of this market segment. Vehicles equipped with 60V and 70V will grow strongly during the forecast period because continuous research and development has increased the speed of vehicles.

Due to the strong industry players in China, India, Japan and Indonesia, the Asia-Pacific region occupies the entire electric motorcycle and scooter market share. Compared with traditional vehicles, traffic congestion, population growth, environmental concerns, and the low prices of these vehicles have led to strong consumer preferences.

By 2024, the European market for electric motorcycles and scooters will grow strongly at a rate of over 15%. European governments are planning to increase sales of electric vehicles to improve air quality. Twenty-seven European countries have begun to levy taxes on car-related carbon dioxide emissions, and 15 countries are offering tax incentives for electronic vehicles. In May 2015, the European Union launched the European Green Car Initiative project jointly created by the European Commission, which involves electric two-wheelers. egvi is a public-private partnership to provide green cars that meet social, environmental and economic challenges.

The few major players include Aima High-tech, Alta Motors, Saura (Jiangsu Xinri Electric Vehicle Co., Ltd.), Zero Motorcycle, Terra Motors, KTM, BMW and Hero Eco. Participants in the electric motorcycle and scooter market are working to develop efficient batteries and motors to ensure high performance. In addition, manufacturers are working to improve the distribution chain of these vehicles.

Acquisitions and product development are expected to remain key strategies for industry players. For example, in January 2015, Polaris acquired Brammo’s electric motorcycle business and entered the electric motorcycle and scooter market. As the main investor in the capital restructuring of Brammo, Brammo will further commit to the development, design and integration of electric vehicle powertrains.

Electric motorcycles and scooters market research report includes in-depth reports on the industry, from 2013 to 2024 in terms of sales (unit: million) and revenue (unit: million U.S. dollars) to estimate the following market segments and prediction:

Major manufacturers competing in the global electric motorcycle and scooters market, each manufacturer’s output, price, revenue (value) and market share; major players include

· Honda Motor

· BMW

· Yamaha Motor

· Emma

· Zero motorcycle

· Sang La

· KTM

· Amego Electric

· Victory Motorcycle

· Amper Vehicles

· Tyra Motors

· Harley-Davidson

· Energy Automobile Company

· Lightning motorcycle

· Alta Motor Company

· Suzuki Motor Company

· Sansan Electric

· Mahindra

· Hero Ecology

· Shandong Inkaqiu Electric Vehicle

· VMOTO Co., Ltd.

· Z Electric Vehicle

· Tail shares

Electric motorcycle & scooter market (by product)

· Motorcycle

· Scooter car

Electric motorcycle & scooter market (by battery)

· SLA

· Li-ion

· NiMH

Electric Motorcycle & Scooter Market by Voltage

· 24V

· 36V

· 48V

· Other (12V, 60V, 72V)

The above information is provided on a regional and national basis for:

· North America

· United States

· Canada

· Europe

· Australia

· Belgium

· Czech Republic

· Sent a

· Germany

· Italy

· Netherlands

· Poland

· Slovenia

· Spain

· United Kingdom

· Asia-Pacific

· China

· Japan

· India

· South Korea

· Indonesia

· Taiwan

· Vietnam

· Thailand

· Malaysia

· South America

· Brazil

· Mexico

· Argentina

· Middle East and Africa

· Saudi Arabia

· United Arab Emirates

· South Africa